Does Insurance Expense Go on the Balance Sheet? Chron com

Contents:

If you use your car for both business and personal purposes, you must divide your expenses based on actual mileage. Generally, commuting expenses between your home and your business location, within the area of your tax home, are not deductible. Unless the uniform capitalization rules apply, the cost of replacing short-lived parts of a machine to keep it in good working condition, but not to improve the machine, is a deductible expense. Generally, repairs you make to your business vehicle are currently deductible.

The date the loan proceeds are deposited in the account. She treats the $800 used for an investment as made entirely from the proceeds of Loan C. She treats the $600 used for personal purposes as made from the remaining $200 proceeds of Loan C and $400 of unborrowed funds. The allocation of loan proceeds and the related interest is generally not affected by the use of property that secures the loan. This chapter discusses the tax treatment of business interest expense. You may either enter into a new lease with the lessor of the property or get an existing lease from another lessee. Very often when you get an existing lease from another lessee, you must pay the previous lessee money to get the lease, besides having to pay the rent on the lease.

Quote & Apply Online

The calculation of the real estate tax deduction for that first year. If you use an accrual method, you can elect to accrue real estate tax related to a definite period ratably over that period. The below-market interest rules do not apply to a loan owed by a qualified continuing care facility under a continuing care contract if the lender or lender’s spouse is age 62 or older by the end of the calendar year.

For example, if your self-employment activity is a sole proprietorship that generated a tax loss for the year, you’re not allowed to claim the deduction because the business didn’t generate any positive earned income. If you are self-employed, you may be eligible to deduct premiums that you pay for medical, dental and qualifying long-term care insurance coverage for yourself, your spouse and your dependents. • The health insurance premium deduction can’t exceed the earned income you collect from your business. • If you’re self-employed, you may be eligible to deduct premiums that you pay for medical, dental, and qualifying long-term care insurance coverage for yourself, your spouse, and your dependents. DE, HI and VT do not support part-year/nonresident individual forms.

Affordable Final Expense Whole Life Insurance can help with end-of-life costs.

Riley owns oil property in which Finley owns a 20% net profits interest. During the year, the property produced 10,000 barrels of oil, which Riley sold for $200,000. Riley had expenses of $90,000 attributable to the property. The property generated a net profit of $110,000 ($200,000 − $90,000). Finley received income of $22,000 ($110,000 × 20% (0.20)) as Finley’s net profits interest. Sales of oil or natural gas or their byproducts outside the United States if none of your domestic production or that of a related person is exported during the tax year or the prior tax year.

The combined gross receipts from sales of oil, natural gas, or their byproducts by all retail outlets taken into account in are more than $5 million for the tax year. You cannot claim percentage depletion for an oil or gas well unless at least one of the following applies. Do not deduct any net operating loss deduction from the gross income from the property. When figuring percentage depletion, subtract from your gross income from the property the following amounts. You determine the number of units sold during the tax year based on your method of accounting.

However, these bookkeeper definition don’t apply to the following property. It must not provide for a cash surrender value or other money that can be paid, assigned, pledged, or borrowed. The insurance plan must be established, or considered to be established, as discussed in the following bullets, under your business. Business interruption insurance that pays for lost profits if your business is shut down due to a fire or other cause. You must withhold a 0.9% Additional Medicare Tax from wages you pay to an employee in excess of $200,000 in a calendar year. The Additional Medicare Tax is only imposed on the employee.

- If you rent your home and use part of it as your place of business, you may be able to deduct the rent you pay for that part.

- Description of benefits and details at hrblock.com/guarantees.

- A change in the accounting for amortizable assets from a single asset account to a multiple asset account , or vice versa.

- Amortizable startup costs for purchasing an active trade or business include only investigative costs incurred in the course of a general search for or preliminary investigation of the business.

- The COVID-19 related credit for qualified sick and family leave wages is limited to leave taken after March 31, 2020, and before October 1, 2021.

You can also contact an IRS office to get these rates.. However, the number of individuals you can treat as key persons is limited to the greater of the following. Because points are prepaid interest, you generally cannot deduct the full amount in the year paid. However, you can choose to fully deduct points in the year paid if you meet certain tests.

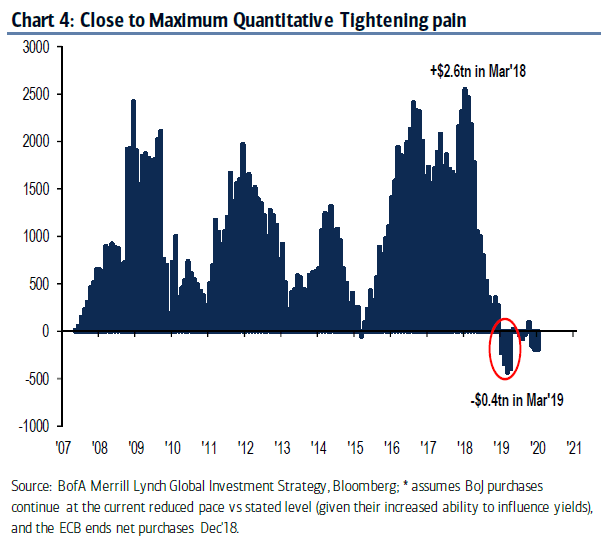

Mounting pressure on the operating expenses of insurance companies

Ordinary and necessary expenses paid for the cost of the education and training of your employees are deductible. Amounts paid or incurred to demolish a structure aren’t deductible. These amounts are added to the basis of the land where the demolished structure was located. Any loss for the remaining undepreciated basis of a demolished structure wouldn’t be recognized until the property is disposed of. You can deduct the cost of meals or entertainment you sell to the public.

Credit Card Trip Delay Insurance: The Ultimate Guide – Forbes

Credit Card Trip Delay Insurance: The Ultimate Guide.

Posted: Thu, 13 Apr 2023 13:00:10 GMT [source]

The following assets are section 197 intangibles and must be amortized over 180 months. You may not be able to amortize section 197 intangibles acquired in a transaction that didn’t result in a significant change in ownership or use. The cost of acquiring assets for the partnership or transferring assets to the partnership. It is for a type of item normally expected to benefit the partnership throughout its entire life. Travel and other necessary costs for securing prospective distributors, suppliers, or customers. The barrier must be removed without creating any new barrier that significantly impairs access to or use of the facility or vehicle by a major group of persons who have a disability or are elderly.

How To Get Tax Help

The cost of admitting or removing partners, other than at the time the partnership is first organized. Accounting fees for services incident to the organization of the partnership. Legal fees for services incident to the organization of the partnership, such as negotiation and preparation of the partnership agreement. It is for the creation of the partnership and not for starting or operating the partnership trade or business.

- If you retire or abandon the property during the amortization period, no amortization deduction is allowed in the year of retirement or abandonment.

- A child includes your son, daughter, stepchild, adopted child, or foster child.

- You have no other fixed location where you conduct substantial administrative or management activities of your trade or business.

- If you deducted an incorrect amount for amortization, you can file an amended return to correct the following.

- This rule does not apply if you dispose of the coal or iron ore to one of the following persons.

Explore how focusing on insurance operating expenses can help companies enhance their expense management capabilities to optimize margins and sustain profitability. Profitability ratios are financial metrics used to assess a business’s ability to generate profit relative to items such as its revenue or assets. Insurance companies typically use statutory accounting as opposed to generally accepted accounting principles accounting to calculate their expense ratios, as statutory accounting yields more conservative ratios. With the investment portion, the insured person can also opt for fixed income to be received after attaining a certain age. The amount of premium is normally within the budgets of normal earning person & hence, paying the premium is not that difficult. The basic advantage is that the insured person attains financial security in the situation if the event occurs.

You can prepare the https://1investing.in/ return yourself, see if you qualify for free tax preparation, or hire a tax professional to prepare your return. The costs of outplacement services you provide to your employees to help them find new employment, such as career counseling, resume assistance, skills assessment, etc., are deductible. Education expenses you incur to meet the minimum requirements of your present trade or business, or those that qualify you for a new trade or business, aren’t deductible. This is true even if the education maintains or improves skills presently required in your business.

Free Worry-Free Audit Support is available only for clients who purchase and use H&R Block desktop software solutions to prepare and successfully file their 2022 individual income tax return . It does not provide for reimbursement of any taxes, penalties, or interest imposed by taxing authorities and does not include legal representation. Additional terms and restrictions apply; See Guarantees for complete details. If you use the cash method of accounting, you can take the deduction for the tax year in which you actually make the repayment. If you use any other accounting method, you can deduct the repayment or claim a credit for it only for the tax year in which it is a proper deduction under your accounting method. For example, if you use the accrual method, you are entitled to the deduction or credit in the tax year in which the obligation for the repayment accrues.

The depletion deduction allows an owner or operator to account for the reduction of the mineral property’s value or basis as a result of the extraction of the natural resource. The federal certifying authority won’t certify your property to the extent it appears you will recover (over the property’s useful life) all or part of its cost from the profit based on its operation . The federal certifying authority will describe the nature of the potential cost recovery. You must then reduce the amortizable basis of the facility by this potential recovery. The facility must not significantly increase the output or capacity, extend the useful life, or reduce the total operating costs of the plant or other property.

Will the new cap on expense limits of insurers benefit policy buyers? Mint – Mint

Will the new cap on expense limits of insurers benefit policy buyers? Mint.

Posted: Wed, 12 Apr 2023 19:34:16 GMT [source]

If you operate a vehicle partly for personal use and partly for business use, deduct only the part of the insurance premium that applies to the business use of the vehicle. If you use the standard mileage rate to figure your car expenses, you can’t deduct any car insurance premiums. You generally cannot deduct expenses in advance, even if you pay them in advance.